SSA-754-F4 2016-2024 free printable template

Show details

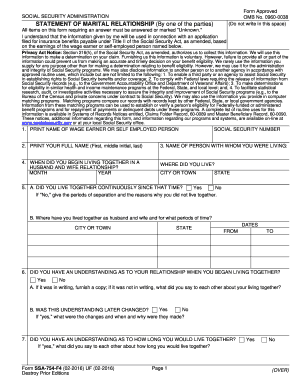

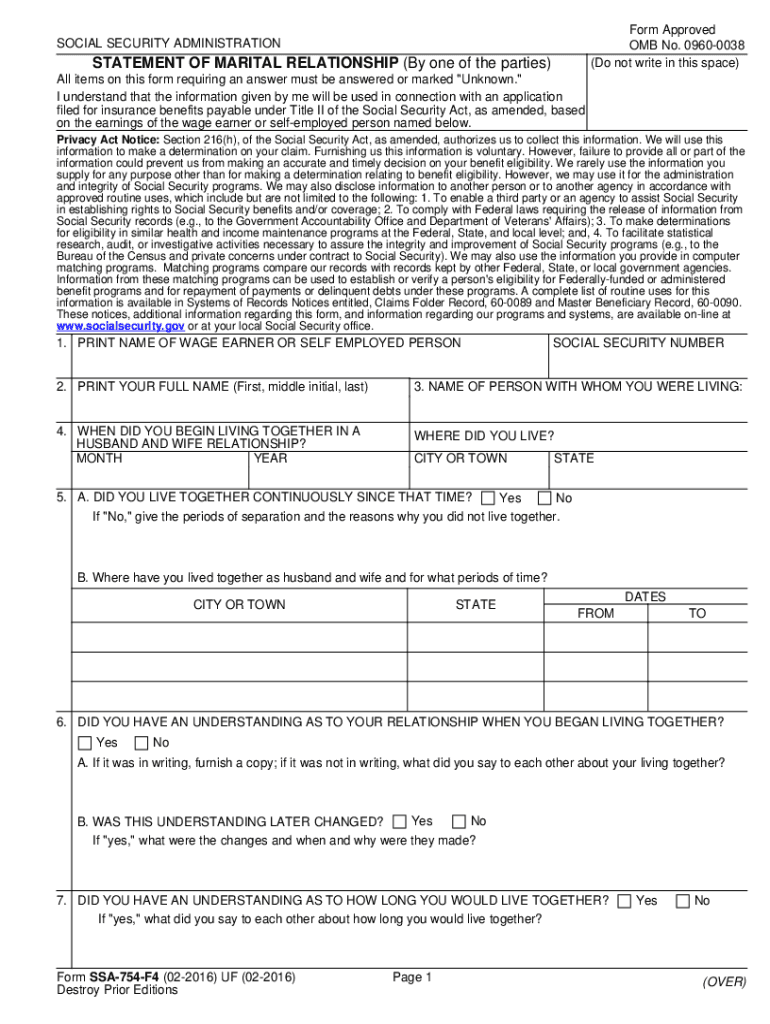

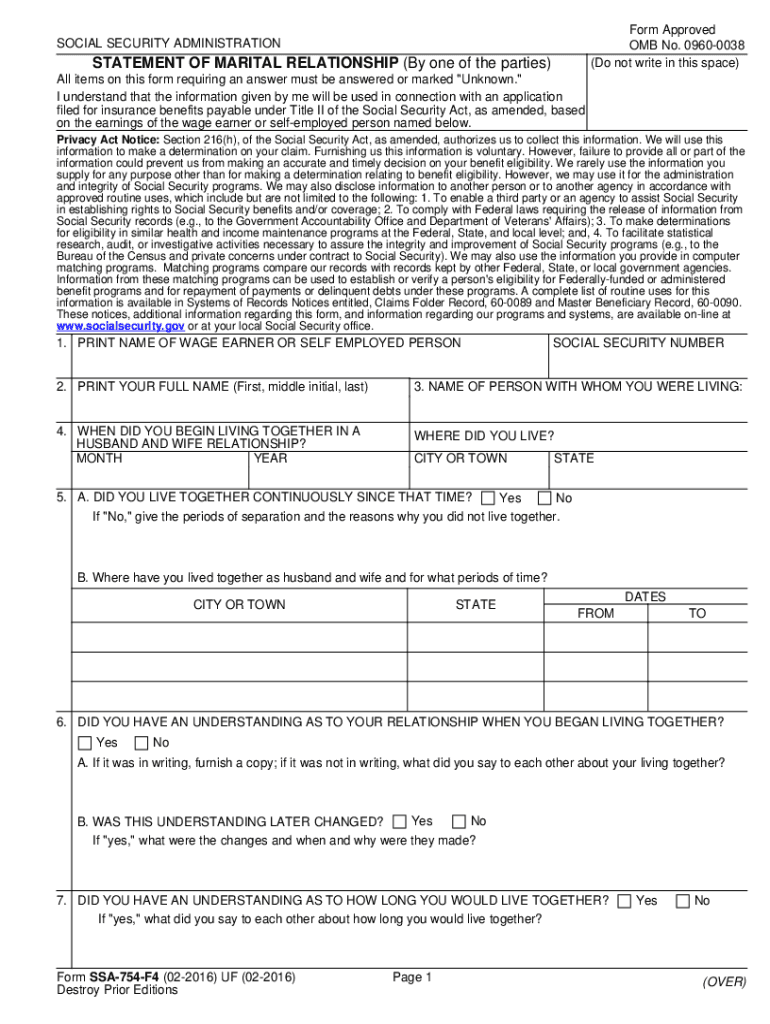

WAS THIS UNDERSTANDING LATER CHANGED If yes what were the changes and when and why were they made If yes what did you say to each other about how long you would live together Form SSA-754-F4 06-2012 EF 06-2012 Destroy Prior Editions Page 1 OVER 8. SOCIAL SECURITY ADMINISTRATION Form Approved OMB No. 0960-0038 Do not write in this space TOE 420 STATEMENT OF MARITAL RELATIONSHIP By one of the parties All items on this form requiring an answer must be answered or marked Unknown. I understand...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your section 754 calculation worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section 754 calculation worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit section 754 calculation worksheet online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 754 election death of partner form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

SSA-754-F4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out section 754 calculation worksheet

To fill out section 754 basis adjustment, follow these steps:

01

Obtain the relevant tax form: You will need to use Form 1065, U.S. Return of Partnership Income, to report the section 754 basis adjustment. Make sure you have the most up-to-date version of the form.

02

Identify the need for basis adjustment: Determine whether your partnership qualifies for a section 754 basis adjustment. This adjustment is required when there is a substantial built-in gain or loss in partnership assets.

03

Calculate the adjustment amount: If you determine that a basis adjustment is necessary, you will need to calculate the adjustment amount. This is done by determining the difference between the fair market value and the adjusted tax basis of the partnership's assets.

04

Complete Schedule M-1: Schedule M-1, Reconciliation of Income (Loss) per Books With Income per Return, is used to reconcile the partnership's financial accounting income with its taxable income. Fill out this schedule and include the section 754 basis adjustment in the appropriate line or box.

05

Attach additional documentation, if applicable: In certain cases, you may need to provide additional documentation to support the section 754 basis adjustment. This could include appraisal reports, valuations, or other relevant information. Ensure that all necessary documents are properly attached to the tax return.

Who needs section 754 basis adjustment?

01

Partnerships with built-in gains or losses: Partnerships that have substantial built-in gains or losses in their assets may need to make a section 754 basis adjustment. This adjustment allows the partnership to adjust the tax basis of its assets to better reflect their fair market value.

02

Partnerships undergoing significant changes: Partnerships that have experienced significant changes, such as the transfer of partnership interests or the sale of partnership assets, may require a section 754 basis adjustment. These adjustments help ensure that the tax basis of the assets aligns with their current value.

03

Partnerships looking to optimize tax planning: Some partnerships may choose to elect the section 754 basis adjustment to optimize their tax planning strategies. By adjusting the tax basis of their assets, partnerships can potentially reduce future tax liabilities or take advantage of certain tax benefits.

In conclusion, filling out the section 754 basis adjustment involves following the necessary steps and determining whether your partnership qualifies for this adjustment. It is important to accurately calculate and report this adjustment to ensure compliance with the tax regulations.

Fill 754 f4 ssa form : Try Risk Free

People Also Ask about section 754 calculation worksheet

Does Social Security verify marital status?

How do I let Social Security know I got married?

What is SSA 795 form used for?

What is a form SSA 2458?

What is a SSA 753 form?

How do I prove my marriage for Social Security?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is section 754 basis adjustment?

Section 754 basis adjustment is a provision in U.S. tax law that allows a partner in a partnership to adjust the basis of their partnership interest when a partner makes a contribution of property to the partnership. This adjustment is made to ensure that the partner's basis in the partnership interest reflects the value of the property contributed.

Who is required to file section 754 basis adjustment?

The executor of a decedent's estate is required to file a Section 754 basis adjustment when the estate includes assets that were owned by the decedent prior to death. This adjustment is necessary to ensure that the decedent's beneficiaries receive the correct amount of basis in the assets that were inherited.

How to fill out section 754 basis adjustment?

Section 754 basis adjustment is used to adjust the basis of assets when an entity has experienced a change in ownership. This section of the IRS code is used to ensure that the basis of assets is properly adjusted for tax purposes.

In order to fill out the form, you will need the following information:

1. The date of the ownership change

2. The name and address of the entity experiencing the ownership change

3. The name and address of the new owners

4. The fair market value of the assets as of the date of the ownership change

5. The adjusted basis of the assets before the ownership change

6. Any adjustments made to the adjusted basis of the assets due to the ownership change

7. The adjusted basis of the assets after the ownership change

8. The signature of the new owner or their authorized representative

9. The date the form is signed.

Once you have gathered all of the necessary information, you can fill out the form. Be sure to include all available information to ensure that the basis adjustment is properly reported to the IRS.

What is the purpose of section 754 basis adjustment?

Section 754 basis adjustments are used to ensure that the basis of assets in an estate or trust are equal to the fair market value of the assets at the date of death or the date of the gift. This ensures that the beneficiary of the estate or trust receives the full benefit of the appreciated value of the assets, and avoids potential double taxation on the appreciation that would occur if the basis of the assets was not adjusted.

What information must be reported on section 754 basis adjustment?

A section 754 basis adjustment must include the following information:

1. The adjusted basis of the property in the hands of the transferee;

2. The adjusted basis of the property in the hands of the transferor;

3. The amount of the Section 754 election;

4. The date of the transfer;

5. The type of property (i.e., real estate, stock, or partnership interests);

6. The identity of the transferor and transferee;

7. A description of the consideration received;

8. Any additional information necessary to calculate and report the gain or loss on the sale, exchange, or other disposition of the property.

When is the deadline to file section 754 basis adjustment in 2023?

The deadline to file a Section 754 basis adjustment in 2023 is March 15, 2024.

What is the penalty for the late filing of section 754 basis adjustment?

The penalty for the late filing of a section 754 basis adjustment is a $10,000 fine per partnership per year. In addition, any adjustments made to the basis of the partnership property are disallowed, and the partnership will be liable for any taxes on the unreported gain associated with the adjustment.

How can I edit section 754 calculation worksheet from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your 754 election death of partner form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit form ssa 754 online?

The editing procedure is simple with pdfFiller. Open your ssa form 4178 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I make edits in ssa 754 form without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your ssa 754 f4 form, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Fill out your section 754 calculation worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ssa 754 is not the form you're looking for?Search for another form here.

Keywords relevant to ssa 754 form

Related to 754 form pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.